9. October, 2020

Withholding tax is changing from 1 January 2021. This change has been brought about as the result of various court rulings due to the unequal treatment of Swiss nationals and EU citizens. The purpose of the overhaul is to eliminate this kind of potential discrimination while also getting rid of the differences between individual cantons.

As an employer, this overhaul of withholding tax entails significant, fundamental changes for you.

The biggest changes relate to part-time employees, as well as people on daily or hourly rates. This is why, in the future, employers who are affected will have more of an interest in what their employees do outside the company as the employer will still be liable to pay the withholding tax and will therefore bear the risk.

Our withholding tax specialists have taken a comprehensive, thorough and careful look at all the aspects and consequences of this new withholding tax, and put together a summary of the most important changes for you.

Read on for brief descriptions of “The most important details at a glance” and “The five most important changes”.

At the end of the document, you will find seven topics that we have looked at in detail, including tables and clear, practical examples. We have included three here, and the rest are available on request or for discussion in person.

Our withholding tax experts are happy to put their expertise at your disposal, either at your premises or ours, in order to allow you, as an employer, to find out about the details of the impending changes and prepare for them as much as possible. So don’t waste any time in arranging an appointment with your advisor or our secretarial office.

Yours faithfully,

MANNHART + FEHR TREUHAND AG

Copyright: Parts and excerpts of tables and figures taken from pwc seminar and swissdec documents – Last updated October 2020

You can find a concise summary of all our information on this topic in our PDF on the subject.

An excerpt of various relevant changes to federal law and the regulations:

You can find a concise summary of all our information on this topic in our PDF on the subject.

Part-time workers and people on hourly/daily rates

The harmonisation with the Swiss tax system means that a person’s entire income (including secondary employment and substitute earnings) is used as the basis for calculating the tax rate. This is why the employers of people who work anything less than full time must include any other work for other employers as well as substitute earnings when determining the rate. This new method therefore eliminates the need for withholding tax tariff D for people in secondary employment.

Starting or ending employment partway through a month

The rate calculation also applies in this case. If an employee does not start their employment at the beginning of a particular month, or end it at the end of a month, the withholding tax rate must be extrapolated to the entire month.

13th monthly salary

The rate of withholding tax for the 13th monthly salary must now be calculated using a special formula if the employee was not employed for the entire period.

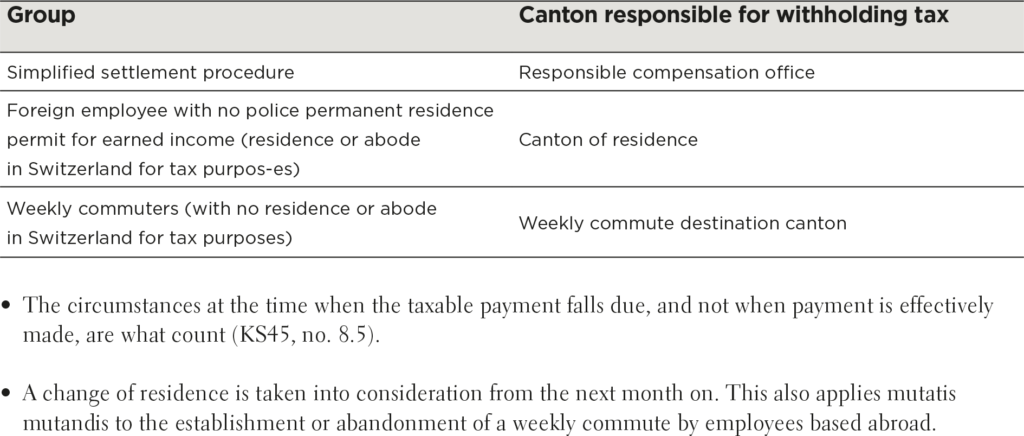

Changing cantonal jurisdiction

The jurisdiction of the cantons is being overhauled. From 1 January 2021, withholding tax must always be settled with the canton that has jurisdiction.

A company will no longer be able to settle exclusively with the canton in which it has its registered office if it employs people from other cantons.

ELM 5.0

The overhaul of withholding tax is also being accompanied by a new standard for payroll accounting programs. Until now, the various programs available have used ELM 4.0 verification. This was entirely limited to the transmission of information between the authorities/institutions and the customer. ELM 5.0 is now to be used to also verify the calculation within the program.

You can find a concise summary of all our information on this topic in our PDF on the subject.

We have prepared information, tables and clear practical examples in relation to the following topics. We have included three below, and the rest are available on request or for discussion in person.

1. Who is liable to pay withholding tax? (see graphic below)

2. Where is withholding tax owed? (see graphic below)

3. What is taxable, and when? *

4. What tariff codes will be used from 2021? (see graphic below)

5. How is withholding tax calculated? *

6. ELM 5.0 (electronic pay reporting) *

7. Monthly or annual model? *

a. Monthly model – with examples for:

> Non-periodic payments

> 13th monthly salary

> Part-time employment

> Employees on hourly and daily rates

> Family allowance

b. Annual model (brief overview)

* We have more figures, practical examples of numbers and specialist explanations available on request or for discussion in person. Our Account Mangers and the Specialist team are happy to help.

You can find a concise summary of all our information on this topic in our PDF on the subject.

You can find a concise summary of all our information on this topic in our PDF on the subject.

You can find a concise summary of all our information on this topic in our PDF on the subject.

For anyone who would like to know more, we have provided a link to the circular from the Swiss Federal Tax Administration for you here as a PDF-Download (only available in German).